Liability Coverage

Liability Coverage is an essential component of commercial vehicle insurance, providing crucial protection for businesses against third-party claims resulting from vehicle-related incidents. At Smartguard, we understand the unique risks associated with operating commercial vehicles in Canada, and we've tailored our liability coverage to meet the specific needs of businesses like yours.

Why is Liability Coverage Important?

- Protects your business from financial losses due to accidents

- Covers bodily injury and property damage to third parties

- Helps maintain your business reputation

- Often required by law for commercial vehicles

What Our Liability Coverage Includes:

Bodily Injury Protection

Covers medical expenses, lost wages, and legal fees if your vehicle causes injury to others.

Property Damage Coverage

Protects against costs associated with damage to other people's property, including vehicles and structures.

Legal Defense

Covers legal expenses if your business is sued as a result of an auto accident.

Tailored for Your Business

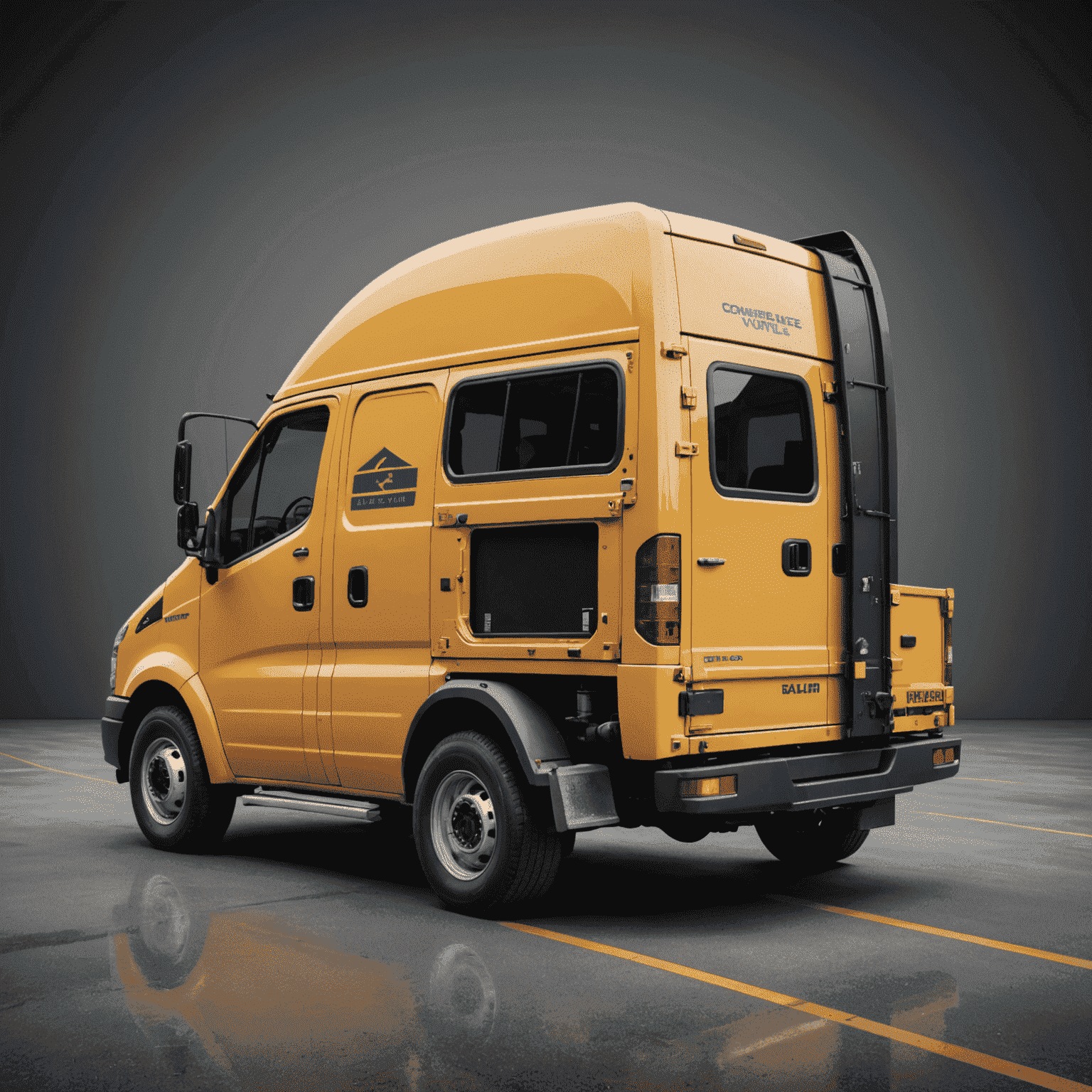

Whether you're operating a single delivery van or managing a fleet of cargo trucks, our liability coverage can be customized to fit your specific needs. We understand that each business is unique, and we're committed to providing the right level of protection for your commercial vehicles.

With Smartguard's liability coverage, you can focus on growing your business, knowing that you're protected against the financial risks associated with operating commercial vehicles in Canada.

Why Choose Smartguard for Your Liability Coverage?

- Expertise in commercial car insurance and cargo car insurance

- Customizable policies to match your business needs

- Competitive rates for comprehensive coverage

- Dedicated support team based in Canada

- Quick and efficient claims process