Policy Coverage Breakdown for Commercial Vehicles in Canada

Understanding the various types of coverage available for your commercial vehicles is crucial for protecting your business. Let's break down the essential policy options for Canadian commercial vehicle owners.

1. Mandatory Coverage

In Canada, all commercial vehicles must have basic third-party liability coverage. This protects you if your vehicle causes injury to others or damage to their property. The minimum required amount varies by province, but it's often advisable to opt for higher limits to ensure adequate protection.

2. Collision Coverage

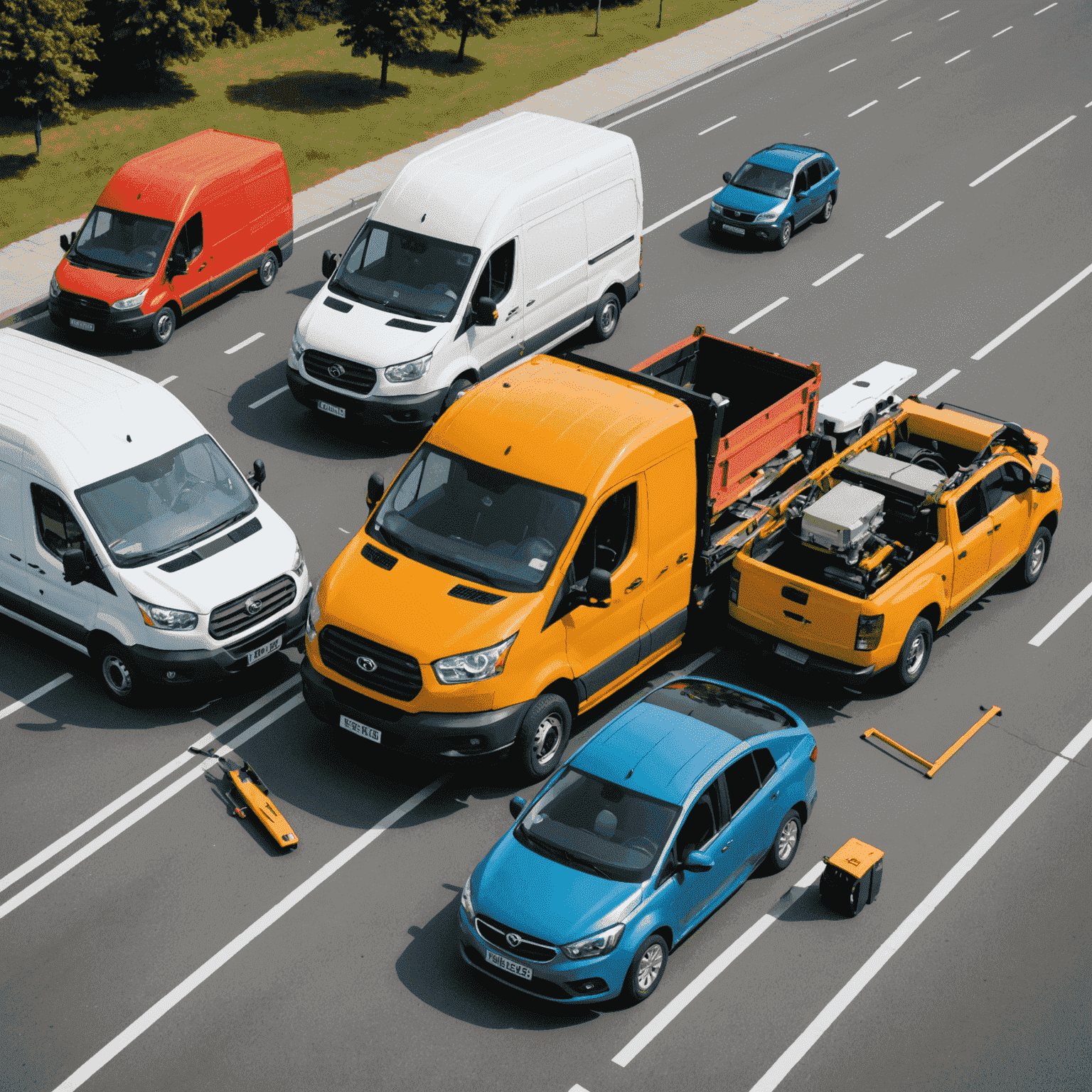

Collision coverage pays for damage to your commercial vehicle if you're involved in an accident, regardless of who's at fault. This is especially important for businesses that rely heavily on their vehicles for daily operations. It helps ensure that your vehicle can be repaired or replaced quickly, minimizing downtime.

3. Comprehensive Coverage

Comprehensive coverage protects your commercial vehicle from non-collision related incidents such as theft, vandalism, fire, or natural disasters. For businesses operating in areas prone to severe weather or with high crime rates, this coverage can be invaluable in safeguarding your assets.

4. Cargo Insurance

For businesses that transport goods, cargo insurance is essential. It covers the loss or damage of freight while in transit. This type of coverage is particularly important for trucking companies, delivery services, and any business that regularly ships valuable merchandise.

5. Non-Owned Automobile Coverage

This coverage protects your business when employees use their personal vehicles for work purposes. It's an important consideration for companies that don't own their vehicles but still have employees who drive as part of their job duties.

6. Specialized Coverage Options

Depending on your specific business needs, you might consider additional coverage options such as:

- Rental reimbursement coverage

- Downtime coverage

- Trailer interchange coverage

- Pollution liability coverage

Key Takeaway

The right insurance coverage for your commercial vehicles is crucial for protecting your business assets and ensuring smooth operations. At Smartguard, we understand the unique needs of Canadian businesses and can help tailor a policy that provides comprehensive protection for your commercial fleet.